In the complex regulatory landscape of financial trading, compliance with MiFID II is paramount.

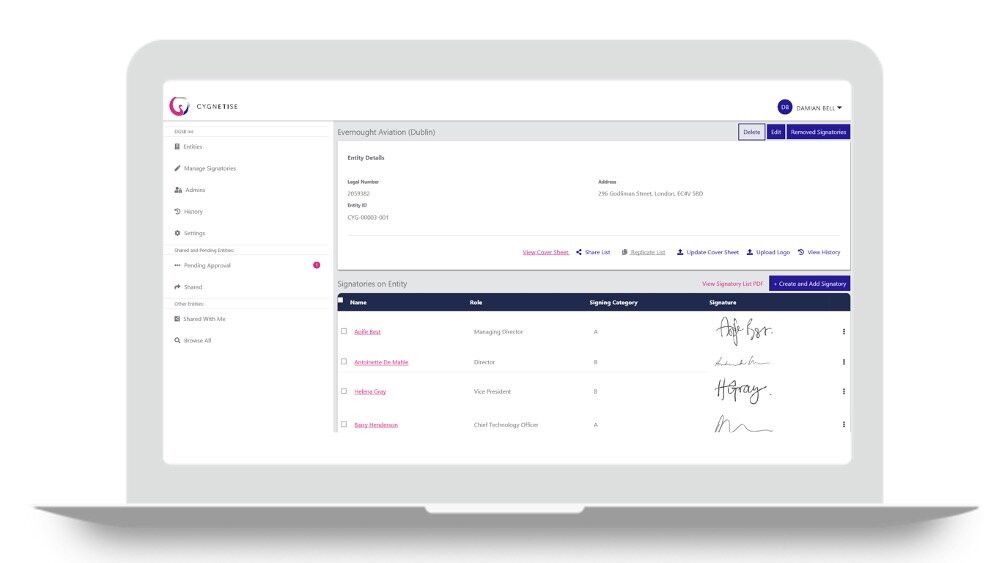

Cygnetise enables financial compliance officers to streamline the management of authorised trader lists under MIFID II by digitising the process and making it more efficient and secure.

Why use Cygnetise

Streamlined internal processes

Enhance efficiency in managing and updating trader lists, aligning with internal compliance workflows. Reduce administrative burdens, allowing you to save time and focus on strategic compliance activities.

Instant updates and notifications

Update trader lists instantly, with real-time notifications to your counterparts. Ensure all parties are immediately informed of any data changes.

Ensure adherence to MiFID II

Have a robust framework in place to manage trader authorisations, facilitating MIFID II compliance and reducing the risk of regulatory scrutiny and sanctions.

“As the world becomes increasingly digital, managing our authorised signatories this way makes complete sense. Cygnetise makes the process clear and simple, and reduces our internal burden. We have control of our data and our counterparts always have access to a real-time updated list, which is good for them and us.”

Key functionalities

✔️ Fit-for-purpose database management: Efficiently manage a database of all employees with trading authorities and bank signing capabilities

✔️ Effortless sharing with trading counterparts: Easily share updated trader lists with your trading counterparts, facilitating smooth and compliant operations

✔️ Simple internal publishing: Easily publish and update lists of trader lists to internal areas

✔️ Reliable audit trail: Maintain a historical record of all changes for audit purposes, crucial for regulatory compliance and internal reviews