How Private Equity is adjusting to the new work from home reality

Working from home or remote working wasn’t common practice in Private Equity (PE) prior to the COVID-19 pandemic. So, how is the sector adjusting after nearly a year of working from home?

According to a survey conducted by eVestment and MJ Hudson in 2019, remote working was not really a thing in the PE sector. Before 2020 - only 7% of PE professionals regularly worked from home. So, like the majority of other financial service providers out there, PE firms experienced a massive disruption to their operations due to the COVID-19 global crisis.

In this blog, we’ll take a look at some of the best practices PE organisations could adopt to handle the crisis and ensure business continuity in the post-COVID digital world. Some leading firms have already started applying these practices and effectively adjusting to the new “remote-first” reality.

Remote working best practices for PE post COVID

At the beginning of the pandemic, McKinsey & Co published a detailed guide on how both PE organisations and their portfolio companies could respond to the crisis. Below is an overview of their key recommendations.

Take care of employees

Firms need to make sure that their employees are provided with the required support and leadership during the pandemic, in line with all governmental measures and guidelines from the local public-health organisations.

According to McKinsey, “many firms are already investing heavily in the blocking-and-tackling needed to expand remote technology and back-office infrastructure (for example, by adding VPN access and extending help-desk hours). We have seen others planning to enhance virtual training (to come back from the crisis with a better-skilled team) and adding benefits such as telehealth services.”

As working from home is a completely new setup for the majority of professionals in the industry, it’s essential for PE firms to facilitate and offer appropriate training options for all their employees.

Leadership is another key challenge. “Firm leaders need to role-model the emerging best practices and ensure their presence (through videoconferences or more frequent informal calls) to maintain both organisational connectedness and ongoing critical activities.”

Ensure continuity of critical processes

Ensuring business continuity in the long term is one of the biggest priorities for all industries during the pandemic, including PE. To survive the crisis, organisations need to keep crucial processes running. For PE, this means continuing to assess the investment pipeline, conducting investment-committee discussions, and managing all other essential processes remotely via video-conferencing.

McKinsey suggests that firms might consider increasing the frequency of interactions in order to reduce lead time on agreed actions. In this way, companies will be able to quickly and effectively respond to fast-emerging challenges such as halting an exit.

In terms of operations, one thing is for sure – the pandemic has significantly accelerated digital transformation in the sector and the need for low- to zero-touch operational models. A number of new trends also arose due to the crisis, including a need for real-time tracking and traceability, adjusting to changes in consumer preferences, especially for value and essentials; changes in credit; and changes in government regulations and policies, such as trade embargoes, sanctions, and other restrictions.

Another major challenge for PE firms during their adjustment to remote working is that of contract management, a fundamental part of which is the management of authorised signing protocols. To facilitate this, many organisations have now moved from “wet signatures” to using electronic signatures. But, whilst e-signing enables business continuity and promotes efficiencies, it can also expose organisations to higher risks of signatory fraud, unauthorised signing and non-compliance. That’s why having a comprehensive authorised signing policy in place should be one of the top priorities for PE firms during the pandemic.

For more information on using e-signatures during COVID-19, you can read our blog here.

Prioritise the portfolio

Where and how to focus their portfolio support and attention is also proving to be challenging for most PE organisations.

According to McKinsey, “some portfolio companies in healthcare or retail are part of the frontline response or provide critical products and services; ensuring that their supply chains are operating at peak performance is essential. Others (such as travel and hospitality companies) are experiencing immediate and unthinkable drops in consumer demand. Since most sponsors have limited resources to share with their owned companies (such as liquidity, operating executives to provide leadership and execution support, and critical relationships with other organizations), they will need to decide where best to allocate time and resources.”

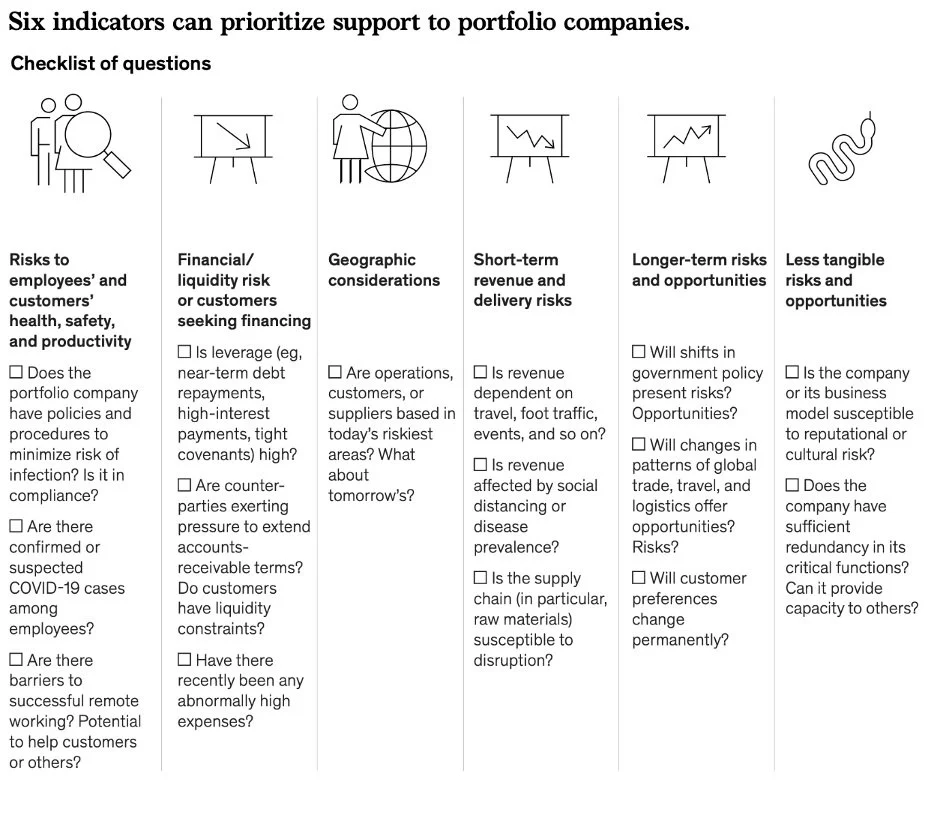

To help organisations, McKinsey have proposed a 6 pillars framework. The model includes a checklist of risk or impact-based questions that allow firms to quickly identify which of their portfolio companies are in greater need of support.

Assess investment strategy, asset allocation and financing

Assessing investment opportunities and asset allocation in uncertain times is also becoming much more difficult for the PE sector. In some cases, private markets sponsors are making an investment decision even with limited information, whilst the majority are preparing for a broader range of investments, such as debt or other types of rescue financing for companies suffering the brunt of the crisis and other situations that are outside the norm for control-equity investors. Whatever the course they opt for, PE firms need to adopt an agile investment strategy so they can move quickly as investment opportunities arise.

Support your limited partners and consider your stakeholders

Last but not least, PE firms should not forget to support their limited partners and stakeholders during the pandemic. Limited partners are often looking for some additional insights from their investment managers during crises. In response, some sponsors have started providing research and insights on a wider range of topics relevant to the broader public and their external stakeholders, re-emphasising their in-place best practice governance and risk management measures and procedures.

Now is also the perfect time for PE providers to consider exploring ways to respond to the unfolding humanitarian crisis.

“At a time when public expectations of business’s role in society are shifting rapidly, firms should consider doubling down on their commitments to environmental, social, and governance (ESG)-related investing and evaluate their actions through a lens of social citizenship, taking a long view as they plot their course.” McKinsey & Co